Want to step off the treadmill? Here’s a fool proof strategy: live debt free.

If your life seems out of balance, maybe the life you’re living isn’t your own. If you’re a doctor, nurse, midwife, med student—anyone who wants to heal the suffering in the world—my message for you is: heal yourself first—and start with your financial health.

My best advice: don’t allow a bank to own your house; don’t allow an employer to own your career; don’t allow anyone to own your life. In short, don’t sell your soul.

I’m a small-town family doc. I live in a sweet cozy home that I own. Paid cash. Previously, I paid off 2 other houses and my student loans by 34. Then I quit working at 36. I’m not retired. I just quit working on someone else’s clock. In fact, I haven’t set an alarm to go to work since 2004. What I do now isn’t work. It’s fun. I see patients 3 afternoons per week. I get up when I want. I do what I want. I don’t owe anyone anything. I’m free. To live. My life.

Thankfully, I only had $22,000 of student loans (paid off in residency). Then I worked as a physician employee at various clinics for the next 7 years. And I paid down those mortgages. My only regret: I could have done it faster.

As a physician employee, I was forced to practice assembly-line medicine. My overhead: 74%. So for every $100 I earned, I kept $26 (pre-tax!). My contract: 193 days/year. So each year I worked 143 days (74% of 193) just to pay overhead. And guess how many patients I had to see in 143 days to subsidize my overhead? At 28 patient visits per day that’s 4004! Just to pay overhead!

Join our upcoming teleseminar & learn how to liberate yourself.

In two years, I generated 1 million in revenue, yet $740,000 went to overhead. While I was in debt. I was nothing more than a physician factory worker selling my soul. My quick route to financial freedom was to eliminate debt and quit my job. In 2005, I opened my own dream clinic. I’ve never been happier. And I’ve never turned anyone away for lack of money, yet I’m more successful than ever. How? My debt-free low-overhead clinic allows me to triple my income per patient (see video) while charging less than big-box prices.

Here’s the bottom line: stop paying interest on your debt and start receiving interest on your income. Keep the revenue you are generating. Please.

So how can you become debt-free ASAP? What’s the secret strategy? I was fortunate to meet up with Cory & Carolyn Fawcett at an event where I was speaking on physician suicide. Carolyn is a brilliant accountant and Cory is a “semi-retired” surgeon who helps distressed doctors in debt. Turns out eliminating debt may even decrease physician suicide.

“In general, doctors do not have an income problem—they make good money,” Cory says. “They usually suffer from an expense problem and are not willing to face it.” Bingo!

In his breakthrough book: The Doctors Guide To Eliminating Debt, Cory provides a quick & easy four-step formula for becoming debt free. Step one: assess the problem by calculating your current net worth (total assets minus total debt = net worth). Step two: establish your goals. Step three: create a spending plan and step four—pay off your debt starting with the smallest loan first.

“Too many people spend money they haven’t earned to buy things they don’t want, to impress people they don’t like,” says Will Rogers. You can break the debt cycle.

Debt-free doesn’t mean deprivation. Without debt, you’re less stressed with more time for vacations (that you don’t need to take!). You can leave your sucky job—without fear. Plus you’ll accumulate more money and have way more fun. Imagine seeing patients because you want to (not because you have to). Best of all: you’ll be able to live your dream.

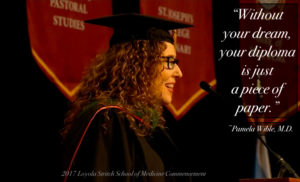

So what’s your dream?

Cory is living his dream by practicing surgery on his own terms. He stopped performing some of the more lucrative procedures he disliked. Now he fills in for rural surgeons (who need vacations) so hospitals can operate in their absence. He also writes books to help docs with their finances.

I’m still practicing medicine in my dream clinic. I also run a suicide hotline for docs and medical students. Plus I host retreats to help health professionals heal from the trauma of their training so they can open their dream clinics too. Most recently, I launched a scholarship fund for medical students.

Cory and I are able to live our dreams because we’re in the debt-free doctors club. Want to join us?

My parting advice:

1) Build a life you don’t have to take a vacation from. Live your dream life in medicine. Here’s how.

2) If you love what you do, don’t retire. Retired means “tired again.” Boredom can hasten your death.

3) Don’t hoard more money than you need. It’s called currency for a reason. Keep money flowing to causes you believe in.

Pamela Wible, M.D., is a part-time family physician and author of Physician Suicide Letters—Answered. Cory S. Fawcett, M.D., is a part-time surgeon and author of The Doctors Guide To Eliminating Debt. He blogs at Dr.CorySFawcett.com. They both practice medicine in the beautiful state of Oregon where Dr. Wible hosts popular physician retreats. Come visit!

Agree with the sentiment, but had to lol at “graduated with $22,000 in debt…”

Average med stud debt is now $190,000. Not possible to pay back in residency. You also appear to be unmarried with no children. Totally OK, but most residents/physicians are not so your advice is not applicable to majority.

White Coat Investor has more achievable information for the mainstream doc, but if you have the option to do above, that’s great.

Basic philosophy will work for anyone. Timeline may differ. Yep, I feel fortunate with the 22K (instead of 220K) but hey, with 220K I’d just be able to pay off one house (rather than two) before 36. It’s doable. Don’t laugh. 🙂

I’m a medical student; I checked out White Coat Investor and I found a bunch of unhelpful articles that gave me anxiety.

I can’t speak to what is on White Coat Investor. I know that the low-overhead debt-free life works great and have helped many people move in that direction. Be ruthless about overhead and debt reduction and your joy and happiness tend to increase in proportion. Happy to help 🙂

Rebecca, sorry for your anxiety. You might want to check out my award winning book “The Doctors Guide to Starting Your Practice Right.” It is written for medical students and residents so they can get started on the right foot and have a rewarding practice. My blog might be a little less technical and hopefully won’t cause any anxiety. If it does, let me know.

Tom, WCI would tell you you can have your $190,000 student loan paid off in the first two years of practice. The amount of debt only changes your timeline. Kids or no kids, high debt or low debt, married or single, the concept and applicability is still the same. Work to pay of the debt as fast as possible and you will be better off in the long run and have more options. I paid off more than $600,000 in less than 6 years without any great sacrifice and show it in detail in the first chapter of my book (Married with two kids by the way). I wrote “The Doctors Guide to Eliminating Debt” specifically for doctors because they kept saying how becoming debt free won’t work for them because their situation is somehow different than someone else’s situation. If I can do it, anyone can do it.

I often run into people who think their situation is somehow different and these universal concepts don’t apply. What holds many docs back is their own psychology.

It is totally possible to do this and live a great life. I have done it too. In fact, I ran up some debts during a period of illness but I have paid them off and I will be essentially debt free again in the next month. I own my clinic building and it will be paid off in full by summer and my home is entirely paid for.

I hate early morning hours so I do not go to work until noon on most days. I take time off when I want and I only do work I consider fun. I agree totally with Dr. Wible that a life like this is possible. The biggest obstacle for most people is believing that they can do it.

I support all physicians who make a change like this. It is the only way we are going to revolutionize the current pathological medical system.

Exactly Ann. Physicians need to support one another so that we can liberate ourselves one by one and then take back our lives and our profession.

Well said as always Pamela!!!!

If you’re only working for yourself you have to obtain medical insurance on your own, rather than through an employer. It is very expensive and often comes with a large deductible. How do solo docs, especially those with a pre-existing condition, add that into the equation? I’m about to go solo in a rural, underserved area and that’s the one thing I’m most afraid of.

I’ve heard good things about Liberty Direct. I favor high-deductible lowest-premium insurance I can find. Not sure what others with pre-eisting very serious costly conditions do. Though certainly the income potential for those in solo practice far exceeds any employed position (if done properly). Premiums can be written off against income on Schedule C.

Look at the health care exchanges, and compare with private premiums. While they may not be around in the same form as in 2017 after 2018, I’m sure there will be something available. You don’t have to be poor to use the exchange, but you won’t get a subsidy.

Cmon, if you are a healthcare provider you should know about the ACA. My bronze high deductible plan is $550/mo, unsubsdized. The ACA is *made* for situations like yours.

Love it ????! Rich is not that who have a lot of material things, but that who can live happily with what he or she has. Is good to have a lot to share but not to sell your soil for it. Love Dr. Wible ❤️

I’m a retired and disabled position. I practiced neurosurgery for 20 years and pain medicine for 10 years. I ended up losing my license to practice medicine in Oregon due to a concerted witchhunt. The Oregon medical board believed numerous lies and wanted to eliminate my medical practice which they accomplished. They also destroyed my life. I am trying to figure out how to set up a consulting business where I would talk to patients about their medical problems and educate them about what is involved in their care but not provide that care directly. I would like to start a website and find patients that are interested in consulting with me. I just today talk to a woman about hers cervical spine MRI. The surgeon had told her that she needed emergency surgery but after talking to her I did not feel that this was the case. I spent over 45 minutes talking with her about her condition the MRI and what the options were in caring for her problem. I recommended an alternative treatment for her condition. I do not know whether or not you could help me and attempting to set up this consulting business Or if you have any recommendations for someone that could help me. I look forward to your response and really enjoy the information that you are providing us. I was definitely suicidal but I am now invigorated and feel that I can make a come back and be more valuable than ever. I look forward to your response.

Thomas – I just sent you a long email. Lots of ideas. Happy to help!

Tom, there is a book I highly recommend called “The Millionaire Messenger” by Brendon Burchard. It spells out in detail how a person with a message can get it out. Start there and see what you think.

I have to agree. Paying off debt is such a relief. I graduated PA school six years ago and paid it all off this month plus undergraduate loans and I now only have less than two years to pay off my mortgage! Now to find a practice that I love. Still stuck in the assembly line medical business world and trying not to drown in it. But knowing that my family of five and I are almost debt free is such a relief!! I love love love that you are encouraging others that this is a possibility. Of course people will need to be comfortable living within their means. Easier to do if you and your family have a minimalist mind set.

Voluntary simplicity lifestyle is a real asset and adds so much meaning to life too. Don’t be imprisoned by your possessions.

Great job on tackling your debts. Life is better without debt.

Do you have a referral for clinics like yours? Or people who might be starting one?

I’ll email you Tom. Happy to help 🙂 I’ve helped 100s of docs all across the country open their ideal clinics.

Well Tom – your email bounced. Contact me via my contact page.

Any advice for medical students?

Absolutely. All concepts apply equally well to med students. Live cheaply. Attend a school that is less costly if possible. UTMB/Galveston is still 17-18K per year in state. What a deal!

My first book “The Doctors Guide to Starting Your Practice Right” was written for the doctor in training. If you read it and start off on the right foot as you begin to practice medicine, your can have a very enjoyable life. Starting on the wrong foot can make you miserable for years.

I couldn’t agree more. When asked why I started writing for physicians, I answered with the following:

I offer perspectives on life and personal finance that can be helpful to most everyone, but I’m specifically targeting my physician colleagues. Doctors are in a rut. The burnout rate is skyrocketing. There are real consequences for the individual physician, and for society at large.

Frustrated doctors can’t deliver the best care. Depressed doctors will find a way out; the suicide rate of female physicians is double that of non-physicians. Efforts are underway to identify and correct some of the underlying causes of burnout, and I’m glad to see the issue being recognized and addressed.

I’m approaching the issue from a financial perspective. I see other doctors trying to buy happiness. Work more, spend more, smile more? Nope. Not working.

My message is this: work some, spend more time doing the things you want with the people you care about, spend less, and create the life you deserve with financial independence. My goal is to educate, entertain, and enlighten my readers, leaving them informed and inspired to consider living a life unlike the stereotypical spendthrift doctor.

Physician on FIRE is another great resource for doctors wanting to live a great life and get their finances under control. There are only a few of us out there advocating for doctors and their finances. Find a few and support their efforts and in a few years, we may have regained control of our profession. Managing debt is keeping us in chains. Eliminating debt is the answer.

Well said, Dr. Fawcett. Thank you for the kind endorsement.

I disagree with the advice “pay off your debt starting with the smallest loan first.” While doing so might inspire a sense of accomplishment, it is more important to pay off the loans with the highest interest first. For example, $20,000 at 1.1% interest should be kept as long as possible, especially if/ when that interest rate is lower than the rate of inflation. [$220/ year in interest is minimal compared to the next example.] A debt of $250,000 at 8% interest should be paid first. With $20,000 in interest accruing annually on that loan, the faster it can be paid, the slower the interest will accrue. Pay it down to $100,000 and it ‘only’ grows by $8,000 per year.

You’ve got a point there. I think maybe it’s the sense of accomplishment that keeps people going with debt reduction. Cory? Your thoughts?

Many people make arguments over how to proceed with paying off debt. Do you pay off the smallest debt first or the highest interest rate first. So let’s look at an example that goes to the extreme (largest debt has high interest and smallest debt has low interest – but it’s often the other way around). If you had a $20,000 debt at 1.1% interest for 6 years paying $287.17 a month and a $250,000 debt at 8% interest for 30 years paying $1,843.41 a month, what would the numbers show?

If you just pay off the debts on schedule you would pay $676.24 interest on the small loan and $410,387.60 interest on the large loan for a total of $411,063.84 of interest.

If you use $3,000 a month to accelerate the payoff of the debts and started with the smallest first, you would pay off the little one in 7 months and pay only $65.31 interest and the larger one would be paid off after 5 years and 7 months for $63,084.69 in interest. Combining the two you paid $63,150 in interest. Saving you $347,913.84 in interest payments.

If you use the same $3,000 a month but start with the larger loan you complete the process in 5 years 6 months and pay interest of $667.39 on the small loan and $57,579.04 on the large loan for a total of $58,246.43 of interest. A savings of $352.817.41 over paying it off over the normal life of the loan and a savings of $4,903.57 over paying off the small one first.

So technically you can save a little more money by paying off the higher interest first but at what cost? You can save in this example $4,903.57 over the course of 5 ½ years. But both loans are being paid up to the end of this. If you do the smaller loan first you have it gone in 7 months and have a relief of $287.17 in your monthly budget for the next 5 years. That means if something comes up, you have extra money available each month to address it. If you are mailing your payments, that would mean 60 fewer checks to write, letters to like and stamps to place. Another savings in your time. If you are paying it online, you have 60 fewer times to check and be sure it was done. You gain momentum by seeing your debts paid off sooner and you have one less stress in your life with each loan retired.

Momentum is the most important factor. Something needs to keep you going. For many people, they have multiple loans and seeing one go away every few months is a great mentality boost. If this were only a math problem, everyone would be rich who can add, subtract, multiply and divide. Since most of us are carrying significant debt, it is not about the math. It is a problem of over spending and living on borrowed income instead of our own income. Many doctors would say, “I couldn’t have gotten through medical school without debt.” This is true. But after you got into practice, did your debt continue to grow or did you start paying it off and it was shrinking every month. Almost all of us continued to borrow money after we didn’t have to anymore. Why?

“If you can borrow money for less than the rate of inflation, you should keep the loan for as long as possible” is the kind of thinking that is keeping doctors in perpetual debt bondage. Making excuses for why you should stay in debt, will keep you in debt. Pay off the debt as quickly as you can and get out of bondage. It really doesn’t matter if you choose to pay off the smallest debt first, or the highest debt first or even the best payment to debt ratio loan first. If you tackle them with a vengeance, the results will be very similar and you will improve yourself by, in this example, about $350,000. That’s about $550,000 you need to earn gross so you can pay the taxes and then the extra interest. What does it take you to earn that much? Each of the methods carry a different set of pros and cons. Neither of them is right or wrong. Just get started now.

I choose to teach people to use the smallest to the largest as it creates the most momentum and the most cash flow relief in their budget. For many doctors, they are struggling to pay their bills, so cash flow relief is more important than saving a few extra dollars over the next 5-7 years. With each debt retired, the cash flow goes up. You figure out what will be best for you and stop managing your debt and start eliminating it. Reading my book “The Doctors Guide to Eliminating Debt” would be a good place to start. You can do it!

I figured we were on the same page here. Momentum is key.

I agree with paying the smallest debt for the psychological boost of seeing debt drop off the liabilities column. It may not be the most money efficient method but if you are using that argument then you can keep the 1.1% loan indefinitely as you are likely to make more money in the market.

The key is to pay off debt! Paying off the smallest works for most people to keep them motivated but at the end of the day do what works for you- but do it! Get debt free.

Thanks for your comments EJ. This method is the simplest to teach the most people. There is a lot of peace of mind in having no debts.

Momentum is not the only answer and low interest debt can be strategically used.

I graduated medical school in the 80s with many low interest or no interest loans. I was able to defer ( with no interest) until after internship, residency , two fellowships and a masters in health care management. All the while the interest on the extra money I borrowed grew.

I took out a home equity loans to prepay both my children’s college tuition in advance. My tuition thereby remained stable for four years. The interest on home equity loan after tax was 2.:5% while tuition increased 5-6% yearly. Net after tax savings on this debt was 1-2000/ year. It paid for books.

When interest rates dropped to 2.75% and excellent stocks were paying dividends well in excess of this I took out a modest home equity loan and invested. The timing was right and not only did i arbitrage the interest, the stock value grew as well.

That being said, these maneuvers are not for everyone and do entail limited risk.

I have lived on half my income since the day I started practice ( except those years my daughters) were in college. I pay cash for every car I have owned and don’t think about a new car until 150000 miles. I just bought my first luxury car and regret it daily.

I use credit cards for everything ( those points have saved me thousands in business class upgrades) but pay them off every month.

If you have access to low interest loans, and are willing to take measured risk, debt is not always bad

“I just bought my first luxury car and regret it daily.” I would too. The costs for repairs and maintenance would be so much higher than my Prius. I’m happy with a car that goes from point A to B with the least cost.

Joe,

Congratulations on winning the money game. You seem to be playing well. The most important thing you did was to make a decision to live on 50% of your income. The other things that make you $1-2,000 a year on interest differential are nearly insignificant when compared to the amount of the savings you have in living on 50% of your income and paying cash for cars.

If you earn $200,000 (average physician) and live on only $100,000 and save the rest, there is no amount of playing with interest that can complete with the $100,000 you earned and didn’t spend. That is the same decision my wife and I made when we got married my internship year. We have lived on half of our income almost every year. There was an occasional hiccup along the way. My book “The Doctors Guide to Starting Your Practice Right” is aimed at getting doctors to not outspend their income from the beginning, so corrections don’t need to be made later. If you live well within your means when you make a small income, you will live well within your means when you have a large income. If you spend more than you make at a small income, you will spend more than you make when your income goes up as well.

Thanks for your comments, yes there are specific times when you can use borrowed money to an advantage. I did it to get an education, to buy investment property, and I took big advantage of the banks when they offered 0% interest on credit cards in the 2000’s. If you are careful and conservative and play the game well, you can make it work. If something goes wrong though, it can go terribly wrong. I think it is better to not poke that skunk. Debt free carries little risk and a lot of peace of mind.

Happy New Year.

Cory & Joe you are both so smart! I wish you could help med students. Please. Some med students are writing me telling me that they are signing up for the “SugarDaddy websites/meetups in hopes of having some financial assistance with food, housing, or books.”

HELP!!!

There are plenty of ways to get the money needed for school without resorting to a sugar daddy or even less savory alternatives.

List a few that you would recommend to med students. I’m curious.

The short answer:

First only apply to inexpensive medical schools. Texas A&M costs $16.432 a year or $65,728 for four years. Columbia costs $57,261 a year or $229,044 for four years. Why pay an extra $163,316 to buy the same thing from a different vender? Be smart in your choices.

Loans are easily available both government and private for the student and the family. Again be smart. Borrow the minimum. I see too many students buying new cars, going to Europe on a vacation, living in a place alone without roommates…….. When you are borrowing money to eat is not the time to be spending on stuff like that. You can do that later, when you can do it with your own money. Don’t borrow extra money just because you can. For every dollar you borrow you will have to earn $4 to pay it back. Poor return on investment if you could have done without the expense.

Apply for a HPSP scholarship with the military. They will pay all the school expenses and give you more than $2000 a month stipend to live on. In return you will take a job with them for every year they pay for your school. Their jobs are pretty good. This was what I choose to do after I had to borrow more money my first year of Medical School than I borrowed for all four years of undergraduate school. I sought and found another solution.

Earn money during breaks. The first year I had the summer off and worked all summer.

But never do any moonlighting during residency. You will be working way too many hours at that point to ever consider working extra. If they are passing laws to limit the hours you work to help your health, it would really be counterproductive to work extra hours anyway. Totally defeats the purpose of work hour restrictions. They didn’t do it so you would have more time to work somewhere else.

YES! First off go to an inexpensive school. UTMB/Galveston where my mom and I went to school in Texas was $900/yr in the 1960s (my mom), $5000/yr in 1990s (me) and around 17K/yr now last I heard. Why pay 200K more for the same education. Actually my mom even discovered that her training was better than brand-name schools on the East Coast because patients in rural Texas give you much more hands-on opportunities to improve skills than say rich folks in Manhattan who only want the specialist (not student doc) to touch them. Get a better education for way less!!!

I’m posting this question for any financial gurus out there who are still following the comments. I am a private practice MD who supports my SAHD, 2 kids under 6 and now… Drum roll… My mother in law (currently healthy.). I have read a lot of MDs obsessing about paying off their student loans. What about mortgage on your home first? My student loan debt is $108 k (2.8%) and next payment due in 2018 bc I already qualified for some fed debt relief since I practice in a rural area. My other large debt is mortgage on our home (no even gonna post the amount but interest is 4% fixed 30 yr) Shouldn’t I focus on increasing mortgage payments to pay off the house before the student loans? My logic is: if I were to die (so morbid), my husband could not pay our house note on his salary potential, but my student debt would be forgiven in the case of my death. And yes, I have term life insurance, but I would rather that go towards college education for my children if I weren’t around to support that effort

Wow. You are really thinking ahead. Impressive. Let’s see what Cory has to say about the order of your payments.

OBGYN kanobi you pose an interesting and common question. Which loan to pay off first. You already have won the game if you have made the decision to pay off your debt ahead of schedule. Great job! My philosophy, and that I teach in my book The Doctors Guide to Eliminating Debt, is to pay off the smallest debt first. But each case is unique so I’m not fond of giving general advice for a specific case without knowing enough details. If you would like specific advice to your situation, contact me directly through my website at DrCorySFawcett.com. That said, here is what I would say.

First off, you seem under insured. You should have enough term life insurance to pay your debts, get your kids through college, and support your family without you. If you feel there would be a tradeoff between paying off the debt and getting your kids through college, you need a larger policy. I have an article on calculating the right amount of life insurance on my blog. Go read that article and determine how much you need and go beef up your coverage.

Second, plan for the usual but prepare for the worst. You are way more likely to live through your student loan repayment than to die. You should have the insurance in place for if you die, so the loan won’t be an issue, but make your decision as if you will be alive.

Third, the effective interest rates are essentially the same for these two loans since the home loan can be partially deducted and you are not likely deducting the student loan interest. So the interest rate dilemma doesn’t apply here. I don’t know what the actual deal is for your student loans but if you have no other debt, like cars or credit cards, then I would consider tackling that smaller debt first. I suspect your home is a much larger debt. By going after the smaller debt first, you will have it paid off much sooner than the house and when it is paid off, your monthly cash flow will improve and increase the amount you can pay extra on the house. If you indeed have a killer deal for someone else to repay the student loan, that might change the plan. But most of these killer deals are not as killer as they seem.

If you read my book you will find a much more in-depth answer to this and many other questions about debt. I hope this helps. Good luck on your journey to become a debt-free doctor.

Thank you!

I will check into your resources in regards to the life insurance issue.

Also, I whole-heartedly agree with Dr Wible about the benefits of simplicity in running an office. I was lucky to find a small private practice in a rural area with amazing partners. Although I haven’t bought in to the building, I am treated like an equal partner and am able to make my own schedule. Overhead is certainly lower than in the hospital-run practices in the city nearby, and my colleagues in these practices are certainly fed up with being treated like a cog in the wheel. Now let me get back to enjoying my day out of the office!